Because of this, they have a tendency not to market self-directed IRAs, which offer the flexibility to invest in the broader choice of assets.

Criminals at times prey on SDIRA holders; encouraging them to open up accounts for the objective of building fraudulent investments. They typically fool traders by telling them that If your investment is accepted by a self-directed IRA custodian, it has to be authentic, which isn’t accurate. Again, make sure to do comprehensive homework on all investments you end up picking.

Believe your friend is likely to be setting up another Facebook or Uber? With an SDIRA, it is possible to spend money on causes that you suspect in; and perhaps take pleasure in higher returns.

And because some SDIRAs such as self-directed standard IRAs are topic to essential least distributions (RMDs), you’ll need to strategy in advance to ensure that you might have enough liquidity to meet The foundations established because of the IRS.

In some cases, the fees linked to SDIRAs is often bigger and even more complicated than with a daily IRA. It's because with the amplified complexity linked to administering the account.

This contains understanding IRS rules, controlling investments, and preventing prohibited transactions which could disqualify your IRA. A lack of information could lead to highly-priced faults.

Increased Service fees: SDIRAs typically have bigger administrative charges when compared with other IRAs, as certain components of the administrative approach can't be automated.

SDIRAs are often used by arms-on investors that are prepared to take on the hazards and obligations of choosing and vetting their investments. Self directed IRA accounts can be great for investors who've specialised expertise in a distinct segment market place which they would want to invest in.

While there are many Rewards affiliated with an SDIRA, it’s not without the need of its very own disadvantages. Many of the common main reasons why traders don’t opt for SDIRAs include things like:

Numerous buyers are surprised to discover that using retirement cash to speculate in alternative assets continues to be possible due to the fact 1974. On the other hand, most brokerage firms and banking institutions concentrate on offering publicly traded securities, like stocks and bonds, because they deficiency the infrastructure and experience to control privately held assets, like housing or personal fairness.

Once you’ve discovered an SDIRA provider and opened your account, you might be pondering how to really start out investing. Comprehending both the rules that govern SDIRAs, along with the way to fund your account, may help to lay the foundation to get a future of effective investing.

Opening an SDIRA can present you with access to investments Usually unavailable by way of a lender or brokerage firm. Listed here’s find here how to begin:

In case you’re looking for a ‘set and forget about’ investing strategy, an SDIRA probably isn’t the right decision. Simply because you are in overall Regulate more than each investment created, It can be your decision to carry out your own homework. Recall, SDIRA custodians will not be fiduciaries and can't make recommendations about investments.

Array of Investment Options: Make sure the company will allow the categories of alternative investments you’re enthusiastic about, such as property, precious metals, or non-public equity.

No, you cannot put money into your own organization by using a self-directed IRA. The IRS prohibits any transactions involving your IRA as well as your possess organization because you, because the operator, are regarded as a disqualified man or woman.

Just before opening an SDIRA, it’s crucial that you weigh the probable pros and cons according to your distinct money plans and hazard tolerance.

As opposed to stocks and bonds, alternative assets in many cases are tougher to provide or can feature rigid contracts and schedules.

Have the freedom to speculate in Virtually any type of asset by using a possibility profile that fits your investment system; such as assets which have the possible for an increased amount of return.

No matter whether you’re a financial advisor, investment issuer, or other monetary Specialist, examine how SDIRAs could become a robust asset to mature your company and accomplish your Specialist plans.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Michael C. Maronna Then & Now!

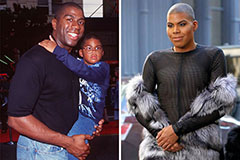

Michael C. Maronna Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Batista Then & Now!

Batista Then & Now!